how to find my student loan account number

Who Is My Educatee Loan Servicer Heres How To Discover Out

DON'T FORGET Business relationship NUMBERS || STUDENT LOANS CREDIT REPAIR

How Student Loan Hero Gets Paid

Pupil Loan Hero is compensated by companies on this site and this bounty may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the market place.

Student Loan Hero Advertiser Disclosure

Pupil Loan Hero is an advertisement-supported comparison service. The site features products from our partners equally well as institutions which are not advertising partners. While nosotros brand an try to include the best deals available to the general public, we brand no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by whatsoever fiscal institution. Whatsoever opinions, analyses, reviews or recommendations expressed in this article are those of the authors lone, and may not have been reviewed, canonical or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers become the answers they need. Read more than

How do we make money? Its actually pretty simple. If you cull to check out and become a customer of any of the loan providers featured on our site, we go compensated for sending you their way. This helps pay for our amazing staff of writers .

- What should I do after finding my loan servicer?

How Do I Consolidate Student Loans

The procedure for consolidating your student loans depends on whether you lot have private or federal pupil loans. If you accept individual loans or want to combine private and federal loans into one, you'll need to refinance them with another private loan. You can consolidate multiple federal loans into ane new federal loan through a Direct Consolidation Loan, which you can prepare through the Federal Student Aid website.

Change Or Cancel Auto Pay

Don't Miss: How To Get Canonical For Hud Habitation Loan

Reservist Status In The Canadian Forces

If y'all are a reservist in the Canadian Forces on a designated functioning yous can filibuster repayment and interest on your student loan.

Complete the Confirmation of Posting Consignment for Full-Time Students form and submit information technology with your loan application to maintain your involvement-free status. Make certain you attach a copy of your notification of posting instructions that you received from the Department of National Defense.

If you need help with this, contact your provincial or territorial student aid part.

What If The Final Amount I Pay Is Not Quite Plenty To Pay My Loan In Full

If your payment is not plenty to pay your loan in full, the payment will be applied to your loan every bit payments normally are, and you will proceed to receive billing statements from Nelnet until you lot make the payment that pays the loan in full. To learn more about how your payments are applied, encounter How My Payment is Allocated.

Don't Miss: Can Yous Get An Fha Loan To Buy Land

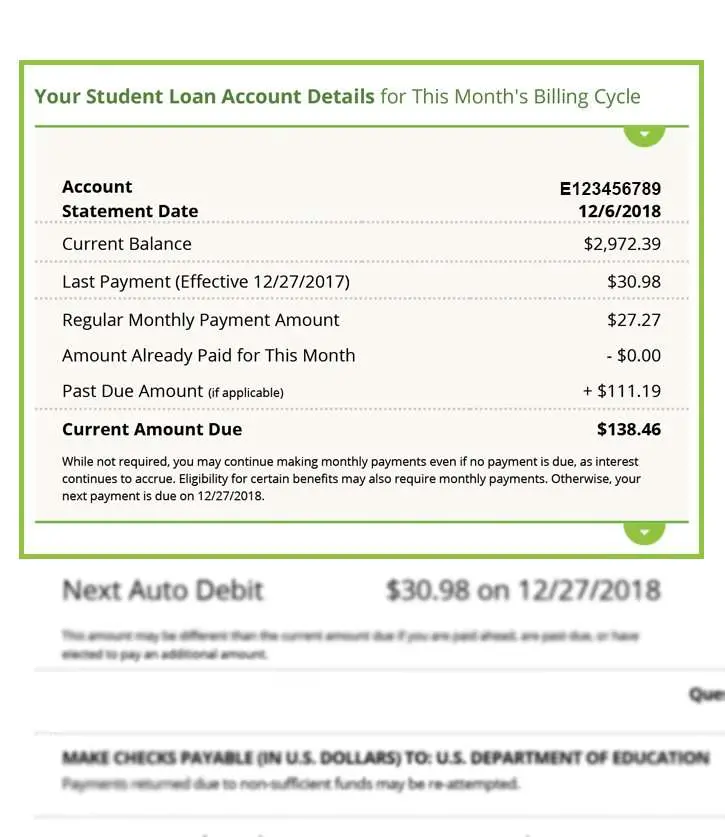

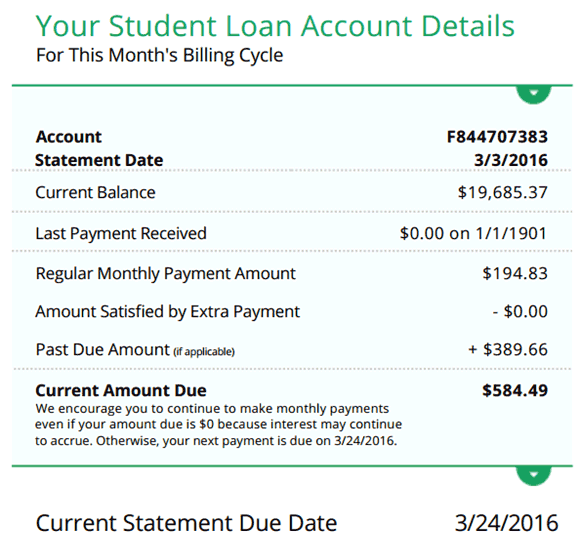

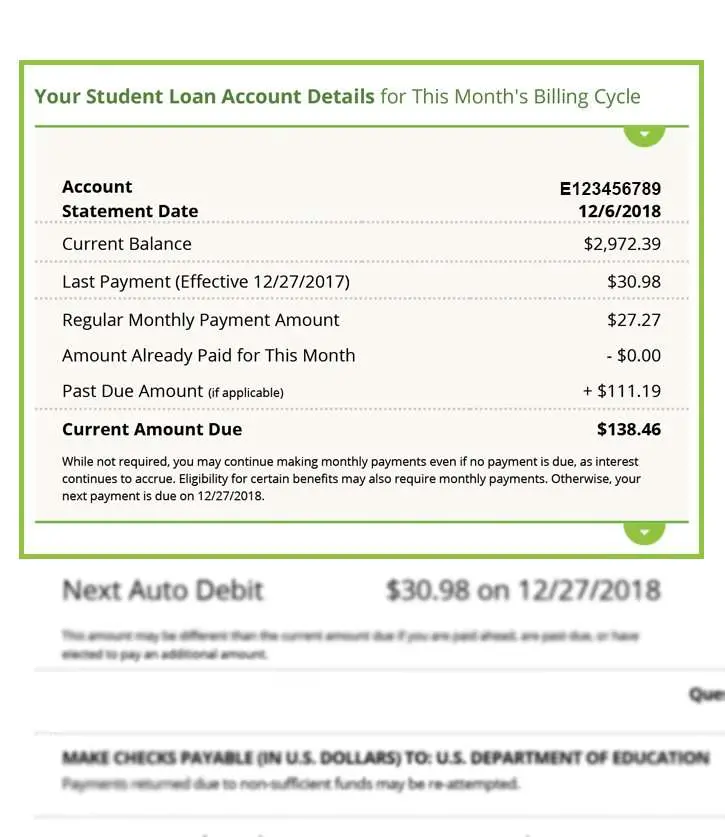

When Will My Payment Be Posted To My Nelnet Account

Once payments are received, it can take up to ii business organization days to post to your business relationship. A payment made online, over the phone, or through check/coin order sent past you lot or your neb pay provider is posted effective on the appointment of receipt.

Note: A payment made online or over the telephone must be submitted by 4 p.chiliad. on a concern 24-hour interval to be effective the aforementioned day. If you submit a payment after four p.m. on a business organisation solar day, you are given the selection to select an effective date every bit early as the following business day. Business organization days do non include weekends.

Are There Any Fees Associated With Repaying A Federal Educatee Loan

If you are late on a payment or your payment is returned, your lender has the discretion to charge you a fee. * Your lender may accuse other fees related to collecting a defaulted loan. Below is a list of possible fees. If you have specific questions regarding fees, contact us.

* The U.S. Department of Teaching does non assess belatedly or returned payment fees. back

- Belatedly fee: Whatsoever payment not received within 15 or more days afterwards the due engagement may incur a late fee of upward to six cents for each tardily dollar as determined by your lender and described in the terms of your promissory note. Your late fee is calculated based on the unpaid portion of your regular monthly payment amount. You can detect information well-nigh late fees in the business relationship snapshot on your monthly billing statement.

- Returned payment fee: A payment returned due to non-sufficient funds may exist reattempted a maximum of 1 time. A returned payment may be assessed a $5 fee.

- Miscellaneous fees: You may be charged certain reasonable costs incurred in collecting your loan. Costs tin can include, but are not limited to, chaser fees and court costs.

You lot may reduce this extra price by paying more than your current amount due to embrace the amount of your fee. If a fee is charged to your account, we volition include detailed information almost the fee on your monthly billing argument.

Likewise Check: Can You Use Fha Loan If You Already Own House

Explore Your Educatee Loan Repayment Options

You will receive a package in the mail from the National Student Loans Service Centre that details how much you owe, your proposed monthly payment, and the confirmed interest rate on your loan. Information technology is your responsibleness to set a repayment schedule. Otherwise, your loan repayments volition be automatically withdrawn from the business relationship in which your loan was deposited.

If You Dont Repay Your Loans

How to View Your Federal Educatee Loans

If yous don't brand your loan payments, you volition be in default.

An OSAP loan is considered to be in default when no required payments take been made for 270 days.

Being in default means:

- your debt will exist turned over to a collection agency

- you lot will be reported to a credit bureau

- you could exist ineligible for further OSAP until the default is cleared

- your ability to become a machine loan, mortgage or credit card can be afflicted

- your income revenue enhancement refund and HST rebate tin exist withheld

- interest will continue to build up on the unpaid residue of your loan

Your OSAP debt will only exist erased when you take paid it off in full.

Don't Miss: How To Get An Aer Loan

Who Is My Educatee Loan Servicer

Your student loan servicer is the visitor that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When yous make a payment toward your educatee loan, it is managed by your loan servicer.

Student loan servicers piece of work with borrowers to assistance manage their student loan repayment. If borrowers would similar to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer outset.

Borrowers practise non choose their loan servicer, simply rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Instruction.

Below are nine loan servicers that currently manage federal loans, plus an boosted loan servicer that deals with default resolution though exist aware that this list may soon change.

Originally, the Section of Education had planned to change its roster of servicers in 2020, just while some new contracts have been announced, the but modify every bit of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be 1 of the companies on the listing in a higher place. Annotation likewise that your loan servicer can change during the life of your loan, so brand sure to check your student loan accounts for the most current data.

What Is My Nelnetcom Account

Your Nelnet.com account is a secure section of the Nelnet website where you tin view your account and loan details, make payments, ask to lower or postpone your payments, sign upward for car debit, and more. To access your account, log in with your username and password. If you havent created your online business relationship, you tin can create 1 by clicking the Register button at Nelnet.com.

Don't Miss: How To Check If Loan Is Fannie Or Freddie

What Happens To My Educatee Loan If I Or My Benefitting Student Dies

If you or your benefitting student should pass abroad before your pupil loan is paid in full, your family or representative tin get the loan discharged past sending an original or certified copy of the death certificate to Nelnet. If a death certificate isnt available, other documents are sometimes accepted on a case-past-instance basis. These alternative documents include:

- Verification from an official of a county clerks function stating the student/borrower is deceased and a death document could non exist readily provided

- Alphabetic character from a chaplain or funeral director

- Confirmation of expiry from a consumer reporting bureau

- Declaration of death from a local paper containing enough information to verify the announcement is referring to the educatee/borrower

- Confirmation from the Social Security death registry

Whatever payments made on the loan after the confirmed date of death are returned to the estate. Its important to note that if Nelnet doesnt receive acceptable documentation of death, the loan resumes servicing at the same delinquency level it was being serviced when Nelnet was notified of the expiry.

Online Transfers And Payments

You tin make a payment by transferring funds from a Wells Fargo deposit account or a non-Wells Fargo account through Wells Fargo Online®.

Sign On to Wells Fargo Online®, select your student loan account then Make a Payment.

It could take 1 2 business concern days for this payment to reflect on your business relationship. Payments received by Midnight Pacific Time online volition be effective as of the engagement of receipt. If received afterward Midnight Pacific Time they will exist constructive the post-obit 24-hour interval.

Besides Check: When Practice I Pay Back Pupil Loan

Getting Your Loan Out Of Collection

When you miss 9 months of payments, your federal student loan is sent to the Canada Revenue Agency for collection. Once in collection, you are no longer able to get student assistance. To be able to go educatee aid again, you must bring your loan up to date.

- Contact the CRA to make a payment arrangement and bring your loan up to date

For the provincial or territorial part of your educatee loan, yous demand to contact your province or territory. For borrowers from Saskatchewan y'all may contact the CRA for both federal and provincial parts of your pupil loan.

What If I'grand Behind On Payments Is Delinquent At The Time Im Requesting A New Repayment Plan

To bring your business relationship up to engagement, you lot have the selection to make a payment anytime, anywhere. See How to Make a Payment If you deceit brand the payment to bring your account up to date, Nelnet may exist able to grant y'all a loan abstinence to encompass the malversation. Involvement may continue to accrue during a forbearance, and may be capitalized at the end of the abstinence catamenia. Log in to your Nelnet.com account and select Repayment Options to explore your options.

You May Like: Tin I Loan Coin To My S Corp

Pick : Information On Applying For And Receiving Student Aid

Choose Option 1 if you have questions about:

- How to apply for funding .

- Eligibility issues for funding.

- Application condition.

- Yous can login to your Alberta Pupil Assist account to see your awarding status, payment schedule and your inbox.

If you lot are a current or recent student, login to your Alberta Student Help account to update your address.

Get The Status Of A Recent Payment

How To Remove Pupil Loans From Your Credit Report | Credit Repair Hacks |Student Loans | LifeWithC

Don't Miss: What Is The Maximum Va Loan Entitlement

How Tin I Detect Out How Much Interest I Paid On My Student Loan Last Twelvemonth

If you made any payment that was applied to interest on your student loan during the prior year, this information volition be provided on your IRS Form 1098-East, on your monthly billing argument sent in January and/or February, through the automated telephone system, or by logging in to your Nelnet.com account. If you have more ane loan business relationship, the amount of interest you paid will be provided separately for each account. To determine the total amount of involvement paid for all of your loans, add the corporeality y'all paid for each account.

Supports For Students Affected By Wildfires

Are you affected by the current wildfire state of affairs? Exercise you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast rail your awarding for the Repayment Aid Program.

- For Alberta Student Loans, telephone call i-855-606-2096

Currently in Schoolhouse

If your studies have been disrupted as a result of the wildfires, and you accept:

- Extended your study menstruation

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Pupil Assist Service Eye, or login to your Pupil Assist Account and submit a Request for Reconsideration. Eligible students may receive up to $seven,500 in Alberta Student loan funding to help comprehend unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

Don't Miss: Is My Loan Fannie Mae

Granite State To Stop Servicing Federal Student Loans When Electric current Contract Ends

In the next few months, Granite State will be working closely with the U.S. Section of Education to transfer all federal student loans currently held by Granite State to Edfinancial Services.

Please annotation that this change will not touch the existing terms, programs, or available repayment plans on your loans, nor will it affect the temporary pause of payments and 0% interest benefits practical for the COVID-19 emergency. Auto-debit data will be transferred to Edfinancial Services still, borrowers should contact Edfinancial Services to verify information once the transfer is complete.

Affected borrowers can wait to receive more information most this transfer from ED and Granite State, and one time the transfer is complete borrowers can expect to receive additional information from Edfinancial Services. Be sure to read these notices fully. You can likewise visit StudentAid.gov/granitestate for the latest updates and information on loan transfers.

You tin check your current remainder online, and if yous have questions, please contact Granite Country at 1-888-556-0022.

Whats The Deviation Between The William D Ford Straight Loan Programme And The Federal Family Education Loan Program

Generally, loans in these programs have the same terms and conditions. At that place are a few differences, including available repayment plans, borrower benefits , loan forgiveness programs, and interest rates. The primary difference betwixt the two loan programs is that the U.S. Department of Education funds loans under the Direct Loan Program, and private lending institutions funded loans nether the FFELP. At that place are notwithstanding many FFELP loans in existence, but since July 2010, no new FFELP loans are being made.

Too Cheque: What Are Conventional Loan Rates

Source: https://www.understandloans.net/how-do-you-get-your-student-loan-account-number/

Posted by: amundsonswayse.blogspot.com

0 Response to "how to find my student loan account number"

Post a Comment